Months ago when Bears Sterns was crashing, I took some time to digest some of the problems in the current Economy...particularly a very unique problem that has occurred in the past year which is is Economic slow-down AND inflation.

Months ago when Bears Sterns was crashing, I took some time to digest some of the problems in the current Economy...particularly a very unique problem that has occurred in the past year which is is Economic slow-down AND inflation.These two problems, as I discussed really put the Fed in a pinch because their biggest Economics tools, supply of money in the economy and the federal funds rate help one area of this double sided problem while worsening the other.

There is another double edged sword with this American and World economic meltdown that has occurred, and it's in our view of how to solve the problems.

Partisan politics often create opposing sides that make us wish that everyone could just get along (and see it "our way"). But as problems worsen, people become more passionate about various things, even at the cost of others.

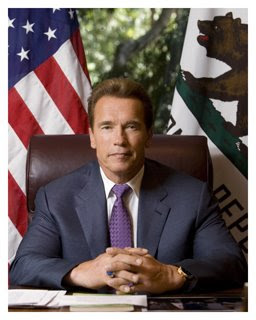

California's budget situation has been an utter mess. With a $15 billion dollar shortfall, the California Legislator has yet to approve their fiscal budget...which began 77 days ago, July 1st.

When I read and listen to the ideas of the politicians it's easy to see where they are coming from. In rough economics times many of the liberal democrats are passionate about seeing that necessary services, like health care and education become primary focuses of the current years budget. In the weak economy, these democrats see the need and role of the government to step in and provide services greater than ever...even at the cost of spending money they don't have (with solutions like buying futures on Wall Street for 2009 California Lottery earnings).

More fiscally minded conservatives see that there is a problem with the budget, that needs to come to an end, not be exacerbated, and are proposing cuts...saying, let's not bite off more than we can chew. They suggests that the last thing Californians need is less of their paycheck coming home, especially in the presents of high gas prices, a credit crunch, mortgage crisis, job loss, and inflation.

Both conceptual ideas make sense, and depending on your tendency towards donkey or elephant politics one seems to make more sense than the other.

The problem is that the lack of a consensus and a decision being made has probably done more harm to Californians than either of the plans, in that the budget has still not been agreed upon, meaning that money that is typically allocated to student loans, social services, schools have yet to be paid...because a budget has not been approved.

The problem is that the lack of a consensus and a decision being made has probably done more harm to Californians than either of the plans, in that the budget has still not been agreed upon, meaning that money that is typically allocated to student loans, social services, schools have yet to be paid...because a budget has not been approved.These plans, strategies and concerns seem very similar to the plans that I hear from the broader political chatter of speechs, ads, and sound bites. The situation with the American economy is historical, and action must be taken, with leadership, vision, and clarity.

Yet for some that action means seeing the government step in and use it's authority to shape and direct America out of these disastrous situations, without diminishing the expectations of American civil liberties and opportunities. While others see a need for the marketplace to be given the freedom to govern itself, for Americans to be given an opportunity to vote with their own paycheck and dollar instead of the government making the decision for them.

Unfortunately in various situations, and with different rhetorical statements, and various examples each case makes sense as the different attempts strive to amend different problems. But look at the situation for a second angle and the plans seem preposterous.

I can't help but think that the situation in California is only a microcosm of problems and situations we will see again and again. Whether it's the government determining whether to bail at Fannie Mae, Lehman Brothers, Washington Mutual, Wachovia, GM, GE, or any number of companies who just might not be able to survive in the coming year...or if it's the government balancing it's budget and trying to decide how much more it needs to go in deficit to save social security, health care programs, and transportation programs.

I can't help but think that the situation in California is only a microcosm of problems and situations we will see again and again. Whether it's the government determining whether to bail at Fannie Mae, Lehman Brothers, Washington Mutual, Wachovia, GM, GE, or any number of companies who just might not be able to survive in the coming year...or if it's the government balancing it's budget and trying to decide how much more it needs to go in deficit to save social security, health care programs, and transportation programs.Honestly, it's an American mess and partisan politics aren't helping.

4 comments:

I feel like some where along the way leaders forgot what it means to lead. The government set a bad example by using debt poorly because in the short term that can qin favor. In the long term of course it is unethical and IMMORAL. The people (companies and individuals) have followed suite. We live in a country where it is ok to have thousands of dollars of debt. Credit cards are given to uneducated teenagers and it ruins their lives. We might as well be giving children chainsaws and cigarets.

It is rediculous that we live in such a bountiful land, yet our nation can't seem to male ends meet. It is not just funny. It's shameful.

I see two sides to this econmic "crisis." On the one hand, obviously there are major problems when you have major, respected financial institutions, some that have been around for decades, biting the dust or needing bailouts. Something is wrong when that happens. On the other hand, when I hear people start panicking and likening today to the Depression, they are far off base. Unemployment was well over 10% for a decade and was at times as high as 25%. The latest current unemployment numbers were around 6%. While that is definitely not great, one data point shouldn't be cause for a run on the bank. The economy is as much psychological as it is financial, maybe more so, so the panic mongers need to be careful that they aren't helping to create a situation that doesn't yet exist, but is being widely perceived.

(For the record I am not counting Strange Culture amongst the panic mongers)

One more thing...

The sub-prime mortgage thing also has me torn. Both lenders and lendees acted foolishly. Lenders irreponsibly shelled out mortgages to just about every shmo who walked into the bank provided they were wearing at least one sock without a hole in it. Said shmos took on the mortgages, usually adjustable, apparently not realizing that they can adjust up as well as down and they ended up getting themselves in way over their heads. So, basically everyone is to blame.

My quandry comes in where the government is concerned. On the one hand if the government lets gigantic financial institutions just wither and die, what is the damage to the rest of the economy going to be? So they bail them out. Some politicians want a bailout for those individuals stuck with the bad mortgages, thereby rescuing them from their own foolishness.

While I don't want to see people thrown out of their homes, or people losing their jobs because the bank they work for just went under, in the long run is the government comeing to the rescue really what we need? Will we really learn our lesson? Won't the same thing happen in another 50 years?

I guess that's the million dollar question, isn't it?

Ok, I'll shut-up now.

Good post RC. I'm still trying to wrap my brain around the current Wall Street melt down. I don't have a particularly sharp economic mind, but I know that it rubs me raw to see the government bailing out so many institutions with our money.

And on what Justbennet said about the credit cards...

I used to work for a Credit Card company that saw low-income/bad credit customers as their target market. It's slimey, for sure, but the accountabilty lies with the card user as well. Ultimately, credit cards aren't "given" to people, we take them. It's our decision. I would assume that most of the adults who make that decision don't wanna be treated like "children", so they should quit acting like them.

Justbennett is right that our culture has created a generation that thinks it's ok to be in debt, but they are also growing up with the assumption that they are entitled to be bailed out as well.

Post a Comment